Over your lifetime, you’ll likely pay hundreds of thousands of dollars into Social Security — but what you get out will depend on a number of factors.

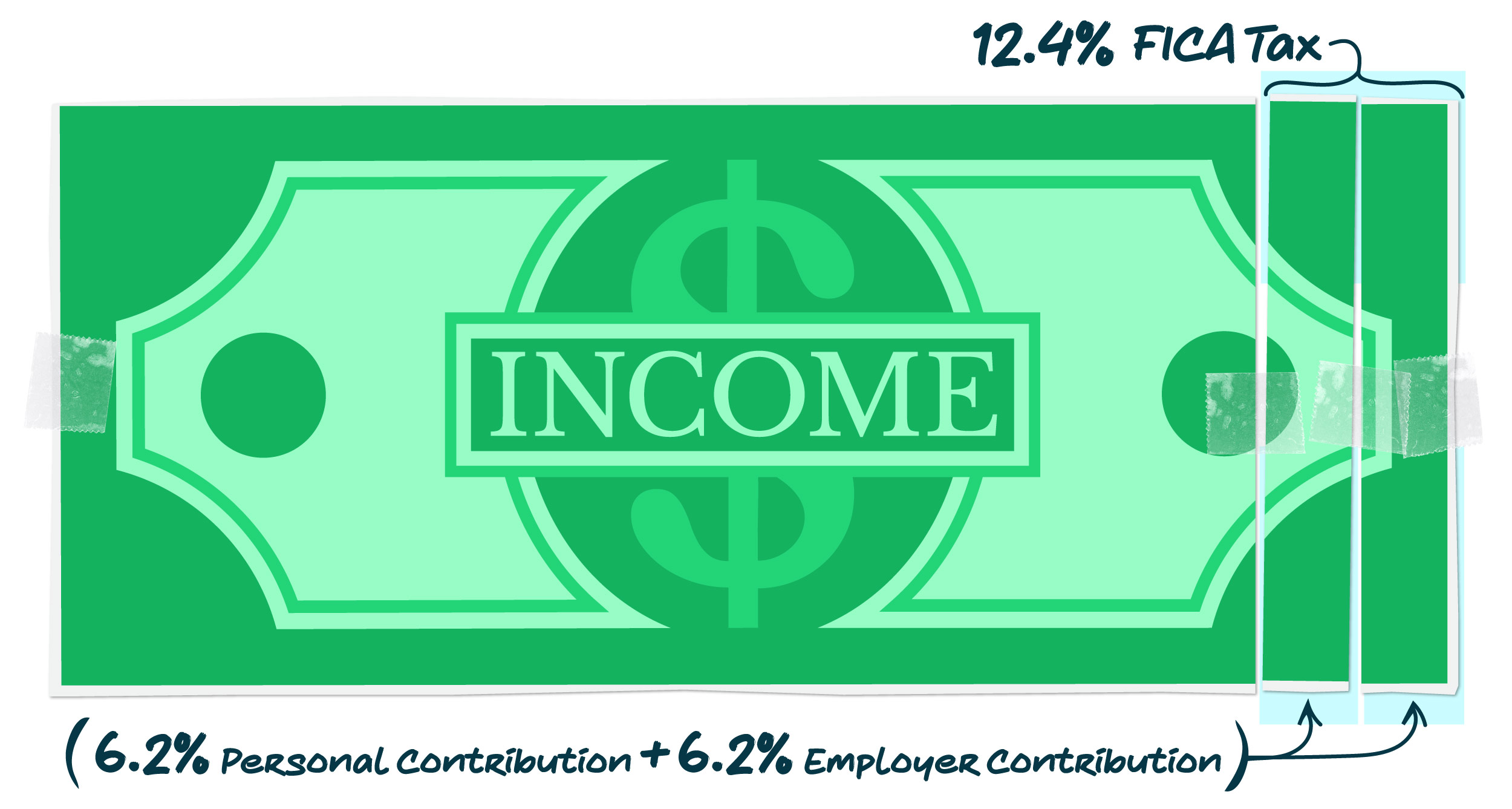

When you’re working, you’ll pay what’s known as the Federal Insurance Contribution Act (FICA) tax. It amounts to a 12.4 percent tax on your earnings; though for accounting purposes, it’s understood that you contribute 6.2 percent (“the employee’s share”), while your employer contributes the other 6.2 percent (“the employer’s share”). But, if you’re self-employed, you’ll pay the full amount directly to the IRS.

If you make enough money, you’ll hit what’s called the “taxable maximum” - and stop paying into Social Security for the year. The taxable maximum normally increases each year. (For reference, it’s set at $168,600 for 2024.)

In other words, if you are lucky enough to make $175,000 in 2024, you would pay a 12.4 percent Social Security tax on every dollar earned up to $168,600, but then stop paying the Social Security tax after that. You would, of course, still pay income and Medicare payroll taxes on every dollar earned, but making more than the taxable maximum means that your marginal tax rate falls.

To get a sense of just how much you’ll pay in taxes — and what you’ll get in return — a helpful analysis was completed by C.E. Steuerle and Karen E. Smith of the Urban Institute. They break it down by marital status and the number of workers in your household. But we’ll walk you through a few examples here based on their analysis:

Let’s keep the first one simple: A single person who made the average wage (about $66,100 in 2023 dollars) and retired in 2020 would have paid about $367,000 into Social Security and would then receive about $383,000 in lifetime benefits.

It’s worth pointing out that, above a certain level of income, you’ll pay more into Social Security than you’ll get out. For instance, a single person with higher lifetime earnings (about ($105,800 a year) who retired in 2020 would have paid about $588,000 and would receive around $508,000 in lifetime benefits.

A single person who hit the taxable maximum throughout their lifetime would see the biggest difference. Retiring in 2020, they would have paid $871,000 and would receive $618,000 in lifetime benefits.

The numbers look a bit different if you get married and whether or not you’re both working. A married couple who both earned the average wage over their lifetime and retired in 2020 would have paid in around $735,000 to Social Security and receive about $812,000 in benefits.

Since Social Security pays benefits to spouses and dependents, even if they don’t pay into the program on their own, the numbers shift a bit when you look at a married couple with only one working spouse. For example, a married single-income couple who hit the taxable maximum would have paid $871,000, but they’d receive $1,055,000 in lifetime benefits. They get more because of the “spousal benefit,” where non-working spouses get a benefit equal to a portion of the working spouse’s benefit.

So while the amount you pay into Social Security is essentially based on your lifetime earnings, the amount you get out depends on your marital status, your dependents, if you retire early or work past your full retirement, and how wage inflation changes over time. And as the debate heats up over how to save the program for future generations, the question of whether Social Security benefits are fair and adequate will become ever more important.

.webp)

.svg)